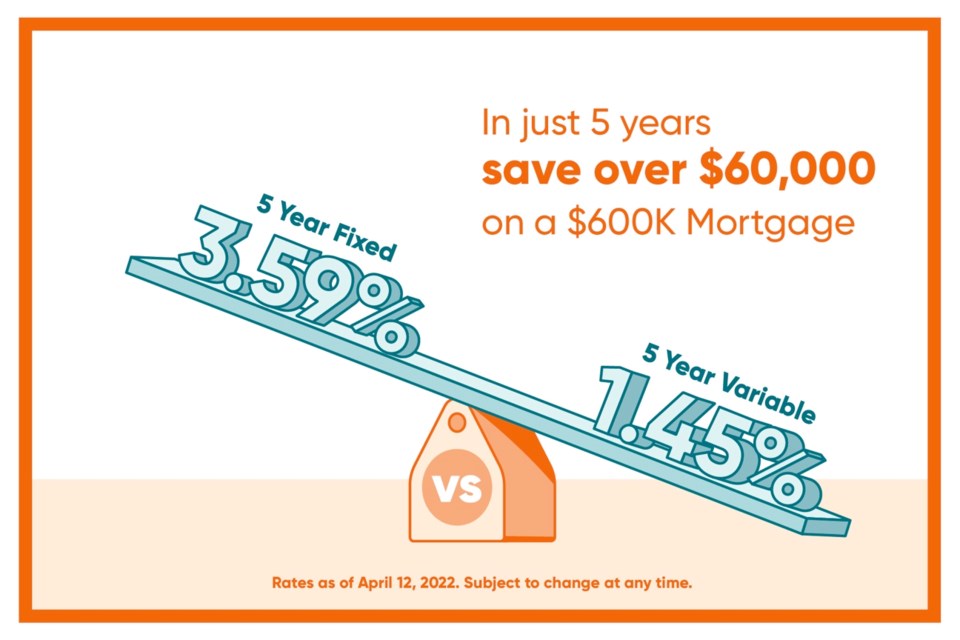

That’s a lot of savings over a 5-year mortgage term, based on True North Mortgage’s current variable versus fixed rates. But it can take a lot of savings to convince homeowners to take on the variable risk — the potential for changing interest rates and payments over their mortgage term.

The above savings (a year’s salary for some) assumes that this gap between rate types will stay the same — it likely won’t. Variable rates (tied to Bank of Canada rate fluctuations) are expected to climb over the next couple of years, which could downsize this savings bonanza by the end of the 5-year term. Yet, fixed rates have also climbed lately, so only time will tell whether this wide of a rate spread will continue to hang in there.

Usually, fixed rates are at least a bit higher than variable rates, because they guarantee that your rate won’t go up and your monthly mortgage payments won’t increase during your term (and so you pay more for that security). But despite the risk of increased payments, these variable savings are a little hard for some to ignore and it’s been turning the mortgage-rate choice upside down.

Why is your rate type such a big decision?

Because each one has a different impact on your mortgage affordability and monthly budget. Typically, most Canadian home buyers prefer fixed rates and the budget certainty they provide. Before the pandemic, about 60 per cent of clients went with fixed, and around 30 per cent chose variable. Now? Thanks to the increasingly-large spread between these two rate types, over 55 per cent have sided with the savings of a lower variable rate. That includes first-time buyers, who face a bigger hurdle to get into over-priced housing markets, and have chosen higher savings over budget predictability.

What rate type is best for you?

Despite the obvious savings right now, it’s not necessarily a slam-dunk decision. The choice can come down to your financial situation, mortgage qualification details, and comfort level with changing rates and payments. Not everyone has the ability to adjust their budget to the varying nature of a variable-rate mortgage. A fixed-rate mortgage may come with a higher rate, but for those whose monthly budget is ‘king,’ the extra cost may be worth their (mortgage) while.

What does a lower variable rate likely mean for you?

- Save thousands compared to a fixed rate

- Pay more down on principal

- Save more on interest costs

- Payments increase if the prime rate goes up

- Pay lower penalties should you decide to break your term

- Need advice on when to switch to a fixed rate

What does a higher fixed rate likely mean for you?

- Protected against rate increases

- Consistent payments during your term

- Possibly higher monthly payments compared to a variable rate

- Pay more for interest costs

- Pay higher penalties should you decide to break your term

- Need your best fixed rate to save more

The good news? You don't have to make this decision alone.

A highly-trained mortgage broker in your corner can help you outline all your options, and provide access to several lenders on your behalf to get your best-possible rate — variable or fixed — with a flexible mortgage that fits you. In fact, the right broker can also help you see the fine print of your 'low-rate' mortgage, to ensure it doesn't come with hidden restrictions or fees that end up costing you more than you planned.

While you’re thinking about your rate type, rates may go up. At True North Mortgage, they have access to several lenders, including their own in-house lender, THINK Financial.

True North Mortgage has seen several fixed rate increases over the past few weeks, as lenders respond to market conditions. If you contact them today or apply online, they can hold your best rate (for which you qualify) for up to 120 days, to protect against further increases (for a little while, at least).

Need mortgage help? True North Mortgage is here to answer all your questions, and hold your best rate. Just follow the link to talk with an expert broker or apply online (it’s easy, free and no obligation). Canada’s No. 1 Mortgage Broker