Those rattled by volatility who shift in and out of the market tend to have poor timing and historically, have received a fraction of market returns.

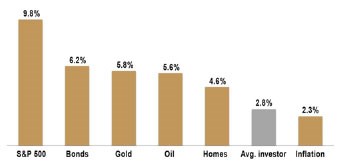

20-year annualized returns by asset class

(1994 to 2014)

Volatility gets a bum rap in the financial services industry. For the average investor, it’s synonymous with risk but can also be a sign of market participants acting emotionally rather than rationally. History proves that in the short term, stock markets don’t operate so much on mathematical principles as they do on behavioural psychology.

It can be a vicious circle. Investors react to short-term “noise” from newspaper headlines and opinionated industry pundits, and buy or sell stocks on emotion. Investors then react to those market movements .... too often the greatest risk investors face isn’t from external forces but rather their own harmful behaviour.

To illustrate the point, say 100 people are asked to price a new pickup truck. Most will accurately peg the truck’s value at between $25,000 and $45,000. Now, say those 100 people are offered the truck for $200. Surely all will accept and lose no sleep thinking they overpaid.

Imagine the same 100 people are asked whether a publicly traded company is worth $50, $100 or $300 a share. No doubt few will have any idea of its worth. What if that company’s share price falls on negative macroeconomic headlines that have no impact on the business’s underlying value? Most likely almost everyone will rush to sell their shares. When you don’t know the value of what you own, there’s almost nothing as uncomfortable as watching its price plummet. That said, when you have insight into value, volatility can be your friend.

Seasoned investors don’t view volatility as risk but rather, as immeasurable opportunity to purchase valuable assets at discounted prices.

About the Author:

This article was provided by Assante Wealth Management, 101 McIntyre - sourced from EdgePoint Investment Group Inc. For over 35 years, Assante 101 McIntyre has been a leader in providing professional financial planning advice for the North Bay community.

Financial Peace of Mind Starts at Assante, 101 McIntyre (705 476 5422)

Assante 101 McIntyre is a branch that is comprised of Assante Capital Management Ltd. (“ACM”) and Assante Financial Management Ltd. (“AFM”) financial advisors. ACM, a registered investment dealer, is a member of the Canadian Investor Protection Fund and is registered with the Investment Industry Regulatory Organization of Canada. AFM, a registered mutual fund dealer, is a member of the Mutual Fund Dealers Association of Canada (“MFDA”), and MFDA Investor Protection Corporation. Please visit https://www.assante.com/legal or contact Assante at 1-800- 268-3200 for information with respect to important legal and regulatory disclosures relating to this notice.